21 OKR examples for Financial Team

What are Financial Team OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Crafting effective OKRs can be challenging, particularly for beginners. Emphasizing outcomes rather than projects should be the core of your planning.

We've tailored a list of OKRs examples for Financial Team to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read more about the OKR meaning online.

Best practices for managing your Financial Team OKRs

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

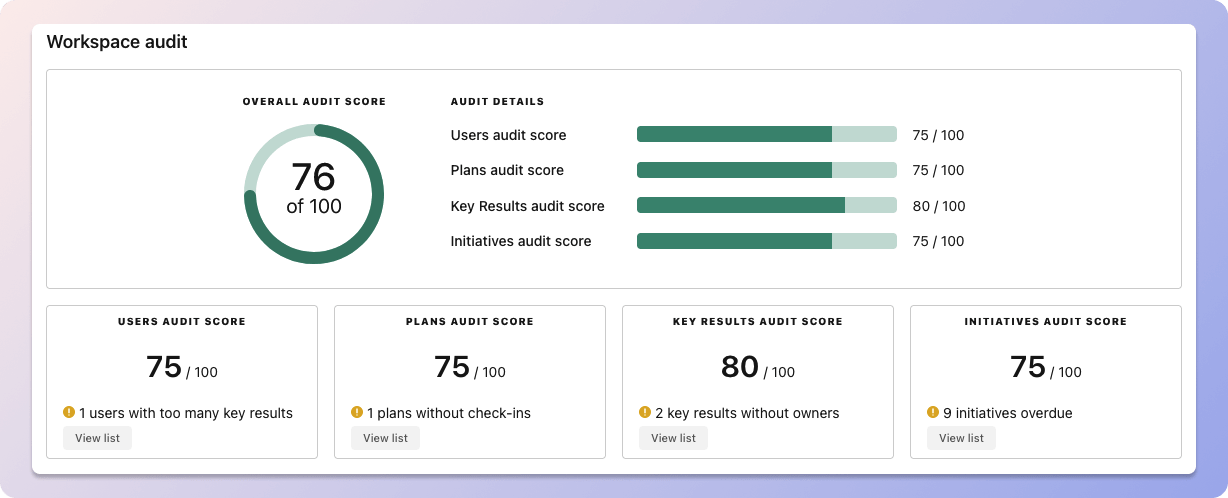

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tability's audit dashboard will highlight opportunities to improve OKRs

Tability's audit dashboard will highlight opportunities to improve OKRsTip #2: Commit to the weekly check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tability's check-ins will save you hours and increase transparency

Tability's check-ins will save you hours and increase transparencyTip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples below). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

Building your own Financial Team OKRs with AI

While we have some examples below, it's likely that you'll have specific scenarios that aren't covered here. There are 2 options available to you.

- Use our free OKRs generator

- Use Tability, a complete platform to set and track OKRs and initiatives

- including a GPT-4 powered goal generator

Best way to track your Financial Team OKRs

The rules of OKRs are simple. Quarterly OKRs should be tracked weekly, and yearly OKRs should be tracked monthly. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use a proper OKR platform to make things easier.

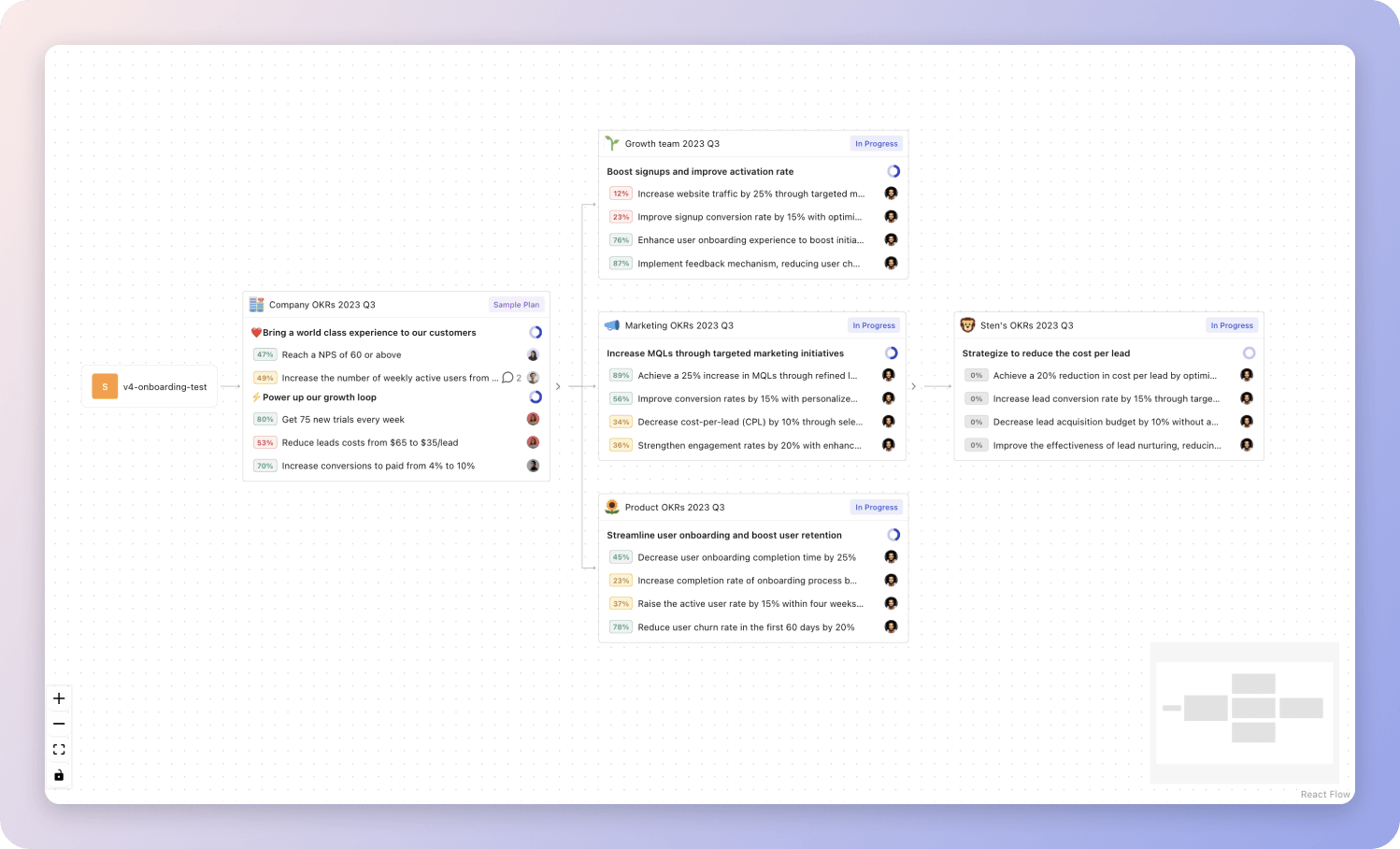

Tability's Strategy Map makes it easy to see all your org's OKRs

Tability's Strategy Map makes it easy to see all your org's OKRsIf you're not yet set on a tool, you can check out the 5 best OKR tracking templates guide to find the best way to monitor progress during the quarter.

Financial Team OKRs templates

We've covered most of the things that you need to know about setting good OKRs and tracking them effectively. It's now time to give you a series of templates that you can use for inspiration!

You will find in the next section many different Financial Team Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to boost finance operations to increase brand visibility and market influence

Boost finance operations to increase brand visibility and market influence

Improve customer satisfaction rates by 25% through streamlined billing processes

Train staff on new streamlined billing processes for better efficiency

Regularly solicit and act upon customer feedback on billing experience

Implement automated, error-free billing system to enhance accuracy

Increase investor presentations by 40% to expand brand visibility

Schedule 40% more investor presentations each week

Create more engaging content for additional investor presentations

Utilize various platforms for hosting investor presentations

Implement new finance software to reduce errors by 30%

Train employees on the new system usage

Research and select suitable finance software

Monitor and evaluate error reduction efforts

OKRs to improve cost efficiency through optimal resource allocation

Improve cost efficiency through optimal resource allocation

Reduce waste in resource allocation by identifying and eliminating non-essential expenses by 20%

Implement and monitor the expense reduction plan

Identify non-essential expenses in current resource allocation

Create a plan to reduce these expenses by 20%

Reduce overall operational costs by 10% through careful cost monitoring and control

Implement regular audits to identify unnecessary expenses

Enforce strict budgeting and reduce waste

Introduce cost tracking systems in all departments

Increase resource utilization rate by 15% while maintaining performance quality

Implement efficient resource allocation strategies

Provide regular training for optimal resource utilization

Monitor and optimize resource usage regularly

OKRs to deliver a well-informed assessment for a potential Series A follow-on investment at XY GmbH

Deliver a well-informed assessment for a potential Series A follow-on investment at XY GmbH

Complete a comprehensive risk-benefit analysis of the follow-on investment

Identify and evaluate potential risks and benefits

Compile and summarize analysis data in a final report

Gather all relevant data pertaining to the follow-on investment

Analyze XY GmbH's financial performance of the past two years

Compare financial KPIs year-on-year to determine performance

Identify notable trends or outliers in financial data

Gather XY GmbH's financial statements from the past two years

Evaluate competitiveness in XY GmbH's market sector

Review customer satisfaction surveys and online reviews about XY GmbH's services

Analyze XY GmbH's product positioning and pricing against competitors

Conduct a SWOT analysis specific to XY GmbH's market sector

OKRs to enhance capital utilization efficiency of auto-parts trading company

Enhance capital utilization efficiency of auto-parts trading company

Increase return on invested capital by 15%

Review and optimize current investment portfolio

Redirect funds to high return investments

Engage skilled financial advisor to reassess strategies

Boost revenue growth by 20% by leveraging existing capital

Invest funds into market research for product improvement

Upgrade technology to improve operational efficiency

Redistribute capital towards more profitable business divisions

Reduce capital waste by 10% through process optimization

Review all processes to identify areas of excessive spending

Train staff on optimized procedures to minimize waste

Implement efficiency measures within identified wasteful processes

OKRs to enhance the architecture of accounting, financial, and tax processes

Enhance the architecture of accounting, financial, and tax processes

Achieve at least a 15% increased in efficacy in financial reporting

Provide thorough training for staff on financial reporting

Standardize reporting templates and process

Implement advanced financial management software

Implement a new, streamlined accounting system capable of reducing process time by 30%

Train staff on the new accounting system

Identify inefficiencies in the current accounting system

Procure or design a streamlined accounting software

Successfully complete 100% of financial and tax process updates without disrupting business operations

Test updates during low-impact business hours

Regularly review existing financial and tax processes

Develop and implement necessary process updates

OKRs to enhance leadership skills to drive financial growth

Enhance leadership skills to drive financial growth

Improve financial planning efficiency by 15 percent

Reduce unnecessary expenses by optimizing budgets

Improve data accuracy to streamline financial forecasting

Implement automated financial planning software

Institute weekly training to increase leadership skillset by 25%

Schedule weekly training sessions for staff

Measure improvement in leadership skills post-training

Identify relevant leadership training programs or workshops

Decrease operational costs by 10%, increasing margins

Consolidate functions where possible for high productivity

Streamline supply chain to reduce inefficiencies

Implement energy-saving measures throughout the organization

OKRs to implement robust fraud prevention and transaction monitoring systems

Implement robust fraud prevention and transaction monitoring systems

Double weekly monitoring audits and reduce detection-to-action time by 30%

Implement faster response strategies for detected issues

Invest in automation tools to expedite detection-to-action time

Increase frequency of weekly monitoring audits to twice a week

Decrease fraud incidents by 40% using advanced detection technology

Implement advanced fraud detection technology in daily operations

Conduct regular system audits to identify vulnerabilities

Train employees on utilization of detection software

Complete incident response training for 100% of the financial team

Schedule training sessions for all team members

Track and record completion rates for team

Identify appropriate incident response course for financial team

OKRs to efficiently meet annual audit plan commitments

Efficiently meet annual audit plan commitments

Finalize and implement a resulting action plan from 80% of audits

Develop action plans based on audit results

Analyze findings from 80% of completed audits

Implement devised action plans systematically

Achieve 100% on-time completion for all scheduled audits

Regularly monitor audit progress and completion rates

Create a structured, detailed audit schedule

Assign and communicate specific deadlines to auditors

Identify and deliver financial improvements in 2 or more audited areas

Analyze recent audit reports to identify areas of financial improvements

Develop feasible strategies to improve audited financial areas

Implement and track the impact of the improvement strategies

OKRs to streamline financial processes for enhanced profit growth

Streamline financial processes for enhanced profit growth

Increase net profit margin by 10% through operational efficiencies

Increase pricing strategy efficiency to boost profit

Streamline supply chain to reduce operational expenses

Implement cost-saving measures in production processes

Improve financial forecasting accuracy by 15% through use of advanced analytics

Train staff on accurate use of analytics tools

Continually assess and refine forecasting model accuracy

Implement advanced analytics software for financial forecasting

Implement two new innovative cost-reduction strategies by the end of the quarter

Develop a detailed plan for implementation

Research and identify potential cost-reduction strategies

Execute and monitor the new strategies

OKRs to strengthen operational self-sufficiency and resiliency within the business

Strengthen operational self-sufficiency and resiliency within the business

Implement two new business continuity plans

Test and refine the proposed business continuity plans

Develop two separate strategies that address these risks

Identify potential risks that could disrupt business operations

Increase emergency fund savings by 25%

Set up automated monthly transfers to emergency fund

Analyze current budget and identify unnecessary expenses

Generate additional income through side jobs

Train 90% of the team on new operational procedures for better autonomy

Implement follow-up assessments to ensure competency

Organize comprehensive training sessions for team members

Develop simplified documentation of new operational procedures

OKRs to optimize AWS Costs

Optimize AWS Costs

Decrease monthly AWS spend by 15% compared to the previous quarter

Implement automatic scaling and resource utilization monitoring for cost-effective resource provisioning

Implement AWS Cost Explorer to analyze spending patterns and identify optimization opportunities

Optimize EC2 instances and remove unused resources to reduce AWS usage costs

Utilize Reserved Instances and Savings Plans to save on compute and database service costs

Identify and eliminate any unnecessary or unused AWS resources

Remove or terminate any unnecessary or redundant AWS resources immediately

Evaluate the purpose and necessity of each identified unused resource

Regularly monitor and audit AWS resources to ensure ongoing resource optimization

Review all AWS resources to identify any that are not actively being used

Implement cost-saving measures, such as Reserved Instances and Spot Instances utilization

Conduct regular cost analysis to track and report savings achieved from optimization efforts

Compile a comprehensive report showcasing the achieved savings and present it to stakeholders

Review cost data and compare it to previous periods to identify potential savings

Analyze cost drivers and evaluate opportunities for optimization in different areas

Implement a system to regularly track and monitor ongoing optimization efforts and cost savings

OKRs to enhance cashflow maintenance for successful resource provision

Enhance cashflow maintenance for successful resource provision

Increase net income by 20% through new revenue streams

Launch new, cost-effective products or services

Implement innovative marketing strategies to attract new customers

Identify potential markets for product expansion

Ensure 100% punctual resource delivery to increase efficiency and productivity

Implement strict deadlines for resource procurement

Regularly review and optimize delivery processes

Set up automated reminders for delivery times

Reduce unnecessary expenses by 15% to boost available cash

Cancel subscriptions and services not needed

Develop a budget, cutting excess by 15%

Review all expenses to identify areas of unnecessary spending

OKRs to increase company profitability

Increase company profitability

Achieve a 10% reduction in operating costs through efficiency improvements

Identify wasteful practices in the current operational process

Implement new efficiency-enhancing technologies

Train staff on cost-saving practices and procedures

Increase net revenue by 15% via new customer acquisition strategies

Conduct market research to identify potential customer segments

Offer incentives for referrals to generate new clients

Develop and implement a targeted digital marketing campaign

Implement cost-saving measures to decrease overhead expenses by 8%

Develop strategies to reduce miscellaneous office expenditures

Review and analyze current overhead expenses in detail

Optimize energy usage to minimize utility bills

OKRs to establish profitability foundations

Establish profitability foundations

Increase sales revenue by 25%

Develop and launch new product lines to attract customers

Enhance customer service to improve client retention rates

Implement a targeted marketing campaign to boost product awareness

Reduce operational costs by 10%

Streamline processes to eliminate waste and improve productivity

Increase energy efficiency to lower utility bills

Review all supplier contracts for potential cost-saving opportunities

Improve net profit margin by 15%

Implement cost reduction strategies across all operational departments

Streamline supply chain to reduce unnecessary expenditures

Increase product prices without impacting customer demand

OKRs to improve financial strategies for customer satisfaction and loyalty

Improve financial strategies for customer satisfaction and loyalty

Improve customer service problem resolution efficiency by 20% through financial investment

Invest in relevant, high-quality training for customer service staff

Implement advanced customer service software systems

Allocate budget for hiring additional customer service staff

Develop 3 new customer loyalty incentives reducing churn by 15%

Design three new loyalty incentives addressing customers' needs and desires

Identify top reasons for customer churn through surveys and data analysis

Implement, track, and adjust incentives based on customer feedback and results

Increase customer satisfaction ratings by 10% through finance-related improvements

Offer financial advice to customers

Resolve complaints regarding billing timely

Implement quicker, user-friendly payment methods

OKRs to increase revenue to achieve $25,000 gain

Increase revenue to achieve $25,000 gain

Decrease operational expenses by 5% through cost management strategies

Negotiate with vendors to lower expenses on supplies

Review and streamline business processes for efficiency

Implement energy-efficient practices to decrease utility costs

Increase sales conversion rate by 10% through strategic marketing initiatives

Optimize website for enhanced user experience

Implement targeted advertising based on customer behavior analysis

Develop a personalized email marketing campaign

Launch 2 new profitable products or services to augment revenue stream

Identify potential products or services based on market demand

Execute a strong marketing and sales strategy

Develop a comprehensive business plan for each product

OKRs to boost financial performance through technological advancement

Boost financial performance through technological advancement

Improve financial reporting accuracy by 30% using advanced data analytics

Provide training for staff on data analytics and accurate report compilation

Implement advanced data analytics tools in financial reporting systems

Regularly review and fine-tune analytics algorithms for optimal accuracy

Increase annual revenue by 25% through implementation of new financial software

Identify and purchase suitable financial software

Train employees on new software usage

Evaluate and adjust software implementation continuously

Reduce operational costs by 15% by leveraging automation tools

Research and invest in relevant automation tools

Identify repetitive tasks suitable for automation

Train staff on effective use of automation tools

OKRs to improve financial operations for increased efficiency and effectiveness

Improve financial operations for increased efficiency and effectiveness

Implement a new budgeting strategy, ensuring 95% adherence to it

Conduct training on new budget adherence

Develop comprehensive, realistic budget strategy

Regularly monitor and assess budget compliance

Reduce operational costs by 10% through optimizing resource allocation

Implement optimization strategies for resource allocation

Evaluate success metrics post-implementation

Analyze current resource distribution for inefficiencies

Increase return on investment by 15% via strategic financial decisions

Implement cost-cutting measures across all departments

Evaluate and identify profitable long-term investment opportunities

Restructure high-cost debt to reduce expenditure

OKRs to effectively manage expenditure within budget

Effectively manage expenditure within budget

Increase savings by 5% through strict budget adherence

Cut down discretionary spending and identify savings

Implement a structured budget to monitor income and expenses

Regularly review and adjust budget for optimal savings

Reduce unnecessary expenditure by 10%

Implement cost-saving measures in those identified areas

Regularly review and adjust budget to maintain reduced expenditure

Analyze monthly financial reports to identify wasteful spending areas

Track and categorize all expenses weekly

Review and adjust budgets based on weekly expenses

Set a weekly reminder to review and log all expenses

Categorize each expense into pre-set budgets

OKRs to enhance the accounting, financial, and tax processes architecture

Enhance the accounting, financial, and tax processes architecture

Implement a new accounting system, improving data accuracy by 30%

Implement regular data accuracy checks

Train staff on new software operations

Research and choose an advanced accounting system

Decrease tax-related errors by 20% through updated software integration

Train staff effectively on new software usage

Research and identify advanced tax software solutions

Implement selected software into company systems

Increase process automation by 25% reducing manual efforts in financial tasks

Train all finance team members on new automated systems

Review and adjust automation protocols regularly for efficiency

Implement advanced accounting software for streamlined financial operations

OKRs to streamline financial application processes through process orchestration

Streamline financial application processes through process orchestration

Decrease average process execution time by 20% compared to previous quarter

Achieve 100% compliance with regulatory requirements in financial process orchestration

Implement necessary process changes and updates to ensure 100% compliance

Identify gaps in regulatory compliance and develop corrective action plans

Continuously monitor and evaluate the effectiveness of the revised financial process orchestration

Conduct a thorough review of current financial process orchestration practices

Ensure process orchestration platform uptime of 99.9% for seamless application integration

Conduct regular disaster recovery tests to ensure seamless application integration in case of failures

Regularly update and patch the process orchestration platform for improved stability and performance

Implement a proactive monitoring system to quickly identify and resolve potential issues

Set up a redundant infrastructure for the process orchestration platform

Increase cross-application data integration rate to 95% for financial processes

Conduct a thorough audit to identify barriers to cross-application data integration

Continuously monitor and refine integration processes to ensure high data integration rate

Provide comprehensive training to employees on using integrated data systems effectively

Implement standardized data formats and protocols to streamline data integration processes

More Financial Team OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to help customers expand usage faster

OKRs to enhance provision of advisory services

OKRs to enhance efficiency and effectiveness of incident management

OKRs to improve organization's DevOps practices and monitoring systems

OKRs to improve test coverage and automation for proactive debt remediation

OKRs to effectively craft and define OKR for strategic clarity

OKRs resources

Here are a list of resources to help you adopt the Objectives and Key Results framework.

- To learn: Complete 2024 OKR cheat sheet

- Blog posts: ODT Blog

- Success metrics: KPIs examples