5 OKR examples for Financial Management Team

What are Financial Management Team OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Crafting effective OKRs can be challenging, particularly for beginners. Emphasizing outcomes rather than projects should be the core of your planning.

We've tailored a list of OKRs examples for Financial Management Team to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read more about the OKR meaning online.

Best practices for managing your Financial Management Team OKRs

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

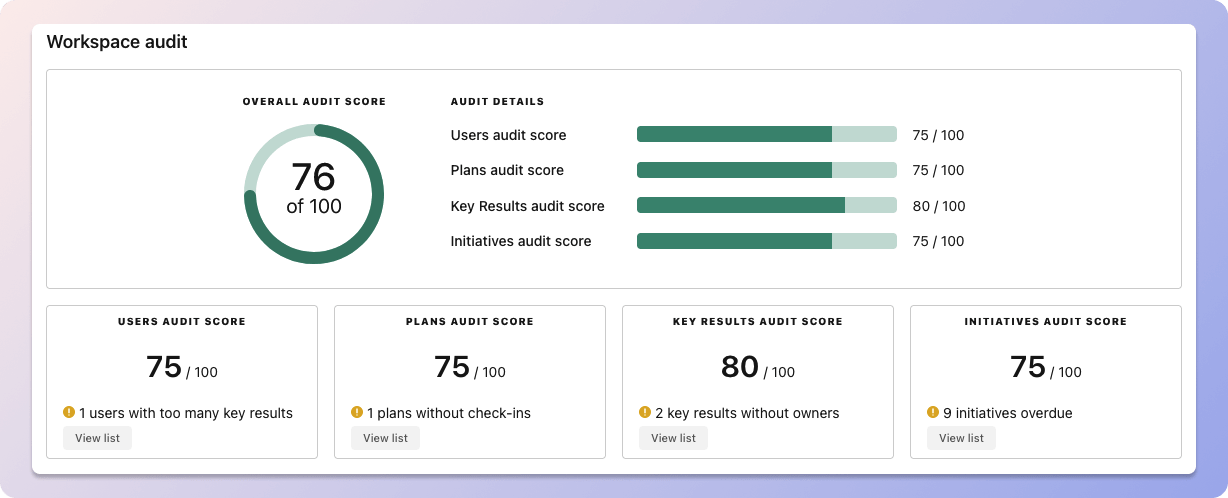

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tability's audit dashboard will highlight opportunities to improve OKRs

Tability's audit dashboard will highlight opportunities to improve OKRsTip #2: Commit to the weekly check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tability's check-ins will save you hours and increase transparency

Tability's check-ins will save you hours and increase transparencyTip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples below). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

Building your own Financial Management Team OKRs with AI

While we have some examples below, it's likely that you'll have specific scenarios that aren't covered here. There are 2 options available to you.

- Use our free OKRs generator

- Use Tability, a complete platform to set and track OKRs and initiatives

- including a GPT-4 powered goal generator

Best way to track your Financial Management Team OKRs

OKRs without regular progress updates are just KPIs. You'll need to update progress on your OKRs every week to get the full benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use a proper OKR platform to make things easier.

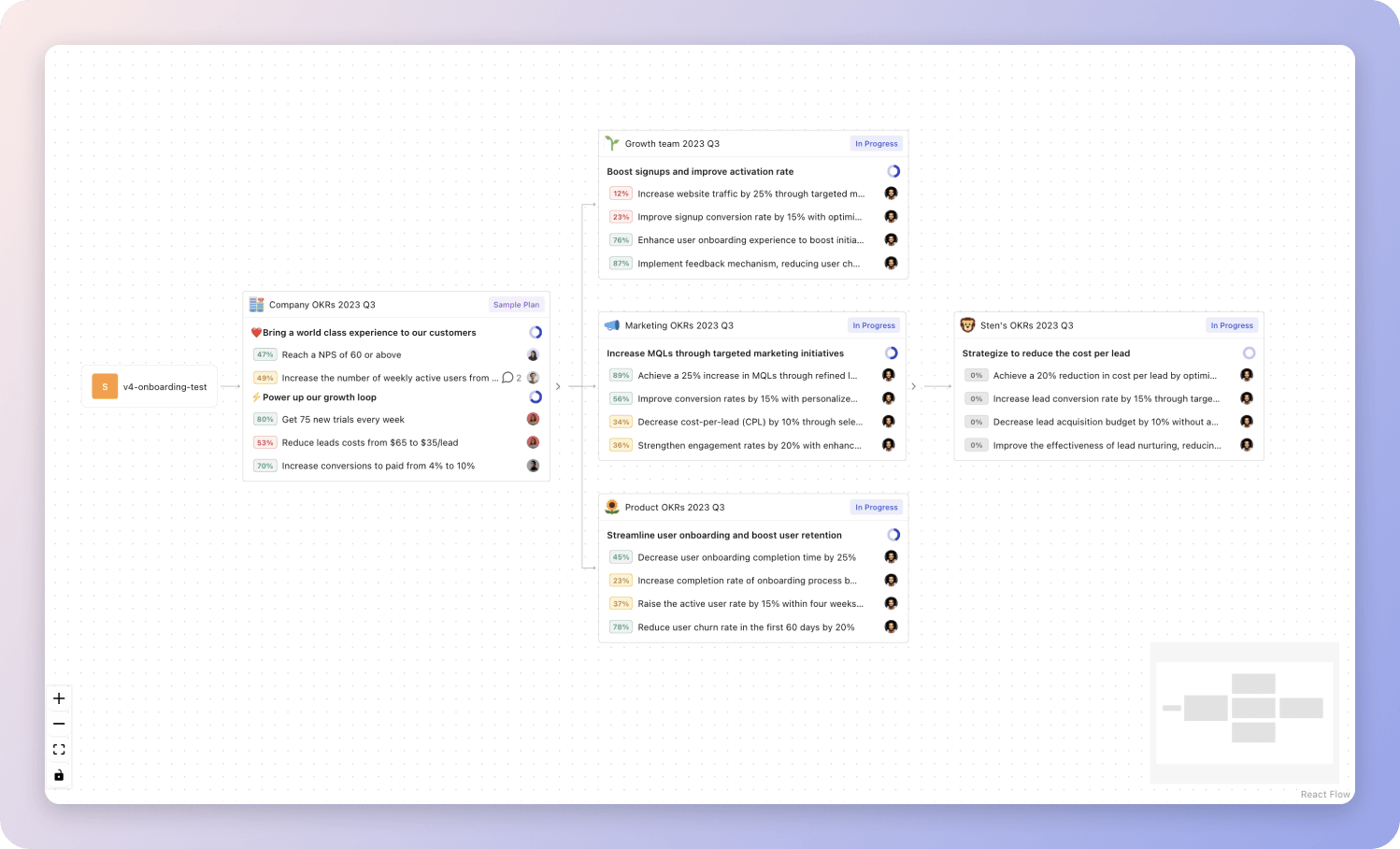

Tability's Strategy Map makes it easy to see all your org's OKRs

Tability's Strategy Map makes it easy to see all your org's OKRsIf you're not yet set on a tool, you can check out the 5 best OKR tracking templates guide to find the best way to monitor progress during the quarter.

Financial Management Team OKRs templates

We've covered most of the things that you need to know about setting good OKRs and tracking them effectively. It's now time to give you a series of templates that you can use for inspiration!

You will find in the next section many different Financial Management Team Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to enhance the architecture of accounting, financial, and tax processes

Enhance the architecture of accounting, financial, and tax processes

Achieve at least a 15% increased in efficacy in financial reporting

Provide thorough training for staff on financial reporting

Standardize reporting templates and process

Implement advanced financial management software

Implement a new, streamlined accounting system capable of reducing process time by 30%

Train staff on the new accounting system

Identify inefficiencies in the current accounting system

Procure or design a streamlined accounting software

Successfully complete 100% of financial and tax process updates without disrupting business operations

Test updates during low-impact business hours

Regularly review existing financial and tax processes

Develop and implement necessary process updates

OKRs to strengthen operational self-sufficiency and resiliency within the business

Strengthen operational self-sufficiency and resiliency within the business

Implement two new business continuity plans

Test and refine the proposed business continuity plans

Develop two separate strategies that address these risks

Identify potential risks that could disrupt business operations

Increase emergency fund savings by 25%

Set up automated monthly transfers to emergency fund

Analyze current budget and identify unnecessary expenses

Generate additional income through side jobs

Train 90% of the team on new operational procedures for better autonomy

Implement follow-up assessments to ensure competency

Organize comprehensive training sessions for team members

Develop simplified documentation of new operational procedures

OKRs to enhance capital utilization efficiency of auto-parts trading company

Enhance capital utilization efficiency of auto-parts trading company

Increase return on invested capital by 15%

Review and optimize current investment portfolio

Redirect funds to high return investments

Engage skilled financial advisor to reassess strategies

Boost revenue growth by 20% by leveraging existing capital

Invest funds into market research for product improvement

Upgrade technology to improve operational efficiency

Redistribute capital towards more profitable business divisions

Reduce capital waste by 10% through process optimization

Review all processes to identify areas of excessive spending

Train staff on optimized procedures to minimize waste

Implement efficiency measures within identified wasteful processes

OKRs to increase revenue to achieve $25,000 gain

Increase revenue to achieve $25,000 gain

Decrease operational expenses by 5% through cost management strategies

Negotiate with vendors to lower expenses on supplies

Review and streamline business processes for efficiency

Implement energy-efficient practices to decrease utility costs

Increase sales conversion rate by 10% through strategic marketing initiatives

Optimize website for enhanced user experience

Implement targeted advertising based on customer behavior analysis

Develop a personalized email marketing campaign

Launch 2 new profitable products or services to augment revenue stream

Identify potential products or services based on market demand

Execute a strong marketing and sales strategy

Develop a comprehensive business plan for each product

OKRs to streamline financial application processes through process orchestration

Streamline financial application processes through process orchestration

Decrease average process execution time by 20% compared to previous quarter

Achieve 100% compliance with regulatory requirements in financial process orchestration

Implement necessary process changes and updates to ensure 100% compliance

Identify gaps in regulatory compliance and develop corrective action plans

Continuously monitor and evaluate the effectiveness of the revised financial process orchestration

Conduct a thorough review of current financial process orchestration practices

Ensure process orchestration platform uptime of 99.9% for seamless application integration

Conduct regular disaster recovery tests to ensure seamless application integration in case of failures

Regularly update and patch the process orchestration platform for improved stability and performance

Implement a proactive monitoring system to quickly identify and resolve potential issues

Set up a redundant infrastructure for the process orchestration platform

Increase cross-application data integration rate to 95% for financial processes

Conduct a thorough audit to identify barriers to cross-application data integration

Continuously monitor and refine integration processes to ensure high data integration rate

Provide comprehensive training to employees on using integrated data systems effectively

Implement standardized data formats and protocols to streamline data integration processes

More Financial Management Team OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to develop a comprehensive understanding of user requirements for secure document backup

OKRs to enhance Salesforce Lead and Pipeline Management

OKRs to maximize pipeline generation from partner channels

OKRs to increase product adoption and engagement among parents and early childhood professionals

OKRs to enhance user experience for increased software engagement

OKRs to achieve proficiency in full-stack development with nestjs, React, and dynamodb

OKRs resources

Here are a list of resources to help you adopt the Objectives and Key Results framework.

- To learn: Complete 2024 OKR cheat sheet

- Blog posts: ODT Blog

- Success metrics: KPIs examples